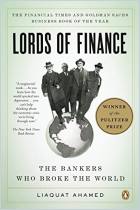

Recommendation

Author Nathan Lewis drops the dismal science of economics to another level of despair by interpreting it as the “cruel science” of realpolitik. True believers in the gold standard, known as “gold bugs,” believe the U.S. could face hyperinflation because it destroyed the gold standard and made every nation vulnerable to contagious inflation. As Lewis explains, ever since President Richard Nixon left the gold standard in 1971, the dollar has been backed by the U.S. government’s “full faith and credit,” not its gold reserves. However, he also introduces theorists who do not advocate the gold standard, since nations can realize its advantages only by pegging their currencies to short-term interest rates. As shown in this thorough, readable history, national treasuries must reassure the timid that global gold and currency markets are so huge and fast that “gold vulture” speculators cannot attack major currencies, and thus force a return to the gold standard (even though the author might wish that they could). getAbstract recommends this to gold buffs, economic historians and anyone who might enjoy the debates it could provoke.

Summary

About the Author

Nathan Lewis was an international economist for an investment research firm and now works for an asset management firm. He advises on gold investing. His work has appeared in the Financial Times, Asian Wall Street Journal, Japan Times, Pravda and other publications.

Comment on this summary or Diskussion beginnen