Article

This Is the One Thing That Might Save the World From Financial Collapse

Amid everything else, there’s a deeper economic crisis underway.

The New York Times,

2020

Read offline

automatisch generiertes Audio

1×

Melden Sie sich an, um die Audiozusammenfassung anzuhören.

automatisch generiertes Audio

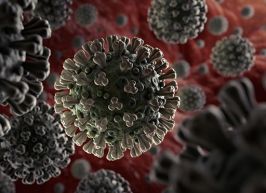

Recommendation

The coronavirus pandemic is affecting the financial system, and politicians and central banks are responding with some of the same strategies deployed during the 2008 crisis. But this time the problem is entirely global, and the world is financially and geopolitically different from what it was in 2008. Professor Adam Tooze looks at what’s changed and what that might mean for the institutions charged with securing the global financial system during an unprecedented crisis.

Summary

About the Author

Adam Tooze is a historian and a professor at Columbia University. He is the author of the award-winning book Crashed: How a Decade of Financial Crises Changed the World.

By the same author

Book

Comment on this summary