Join getAbstract to access the summary!

Join getAbstract to access the summary!

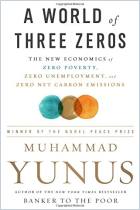

Muhammad Yunus

Banker to the Poor

Micro-Lending and the Battle Against World Poverty

Public Affairs, 2003

What's inside?

How Nobel Prize winner Muhammad Yunus pioneered microcredit to make a revolutionary difference in the lives of the poor.

Recommendation

In 1974, while Muhammad Yunus was teaching economics in Bangladesh, the country was ravaged by famine. Increasingly uncomfortable teaching abstract theories while starving people shuffled by outside his classroom, Yunus realized his economic education was incomplete. To complete it, he went to local villages to "learn from the poor" about what they actually needed rather than what a textbook said they should have. The answer was credit, so Yunus founded a bank to provide it - Grameen Bank. The name means the "bank of the village." Today, Yunus is a Nobel Peace Price winner and Grameen Bank has extended credit to more than 2.6 million people. This down-to-earth, unsentimental autobiography recounts what inspired him, the obstacles he overcame and the ultimate success of this project, his life's work. getAbstract highly recommends it to anyone who wants to know how one person's efforts can have a huge impact.

Summary

About the Author

Nobel Peace Prize laureate Muhammad Yunus is the founder and managing director of Grameen Bank. He chaired economics at Bangladesh's Chittagong University.

Comment on this summary