Join getAbstract to access the summary!

Join getAbstract to access the summary!

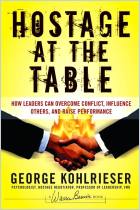

John Ward, Daniel Denison, Lean L. Kahwajy and George Kohlrieser

Unconventional Wisdom

Counterintuitive Insights for Family Business Success

Wiley, 2005

What's inside?

Family businesses have some unexpected competitive advantages, including a basis of trust and a long-range perspective.

Recommendation

This brief book is the product of an academic collaboration but its professorial essays are mercifully clear and free of academic jargon. This collection, edited by John Ward, explores the performance, management and governance issues that matter most to family businesses. The title refers to the fact that family-owned companies are unconventional, at least in comparison to publicly owned businesses and, therefore, they need a distinctive management approach. Family businesses derive competitive advantage from precisely those practices that conventional managers abhor - such as nepotism. getAbstract recommends this book to anyone engaged in a family business, and certainly to other academics studying this subject.

Summary

About the Authors

The authors are professors at IMD, a business school in Lausanne, Switzerland. Daniel Denison teaches management and organization. Peter Lorange teaches strategy. Jean L. Kahwajy and George Kohlrieser teach organizational behavior. Ulrich Steger chairs environmental management. Joachim Schwass co-directs the school’s Family Business Center and teaches family business, as does editor John Ward. Colleen Leif is the Center’s lead researcher.

Comment on this summary