Book

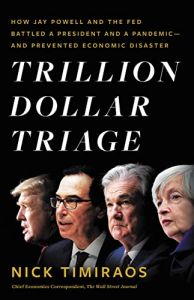

Trillion Dollar Triage

How Jay Powell and the Fed Battled a President and a Pandemic—and Prevented Economic Disaster

Recommendation

During the 2008 global financial crisis, the Federal Reserve and the US government mounted a halting response that prolonged the economic agony. During the coronavirus downturn of 2020, by contrast, the Fed and the feds acted so decisively that they stabilized the economy in just a few months. As the chief economics correspondent for The Wall Street Journal, Nick Timiraos had a front-row seat to the crisis. In this engrossing retelling, he paints Fed Chair Jerome Powell as a steady hand who made the right moves with minimal drama. Perhaps the only weak spot in this account is that it ends while Powell could still term inflation “transitory.”

Summary

About the Author

Nick Timiraos is the chief economics correspondent for The Wall Street Journal.

Learners who read this summary also read

Article

Book

Book

Book

Comment on this summary or Iniciar a Discussão