Recommendation

In this timely and informative report, professionals at the Boston Consulting Group describe the reasons for the glaring racial disparities in access to conventional banking services. The authors point out that, due to financial firms’ role in capital provision, they can address racial inequality by, among other roles, refocusing their efforts on business development and financial advice in communities of color. This cogent analysis carries important insights for financial professionals.

Summary

About the Author

The Boston Consulting Group is a leading global consulting firm.

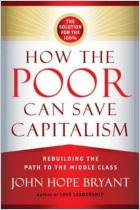

By the same author

Learners who read this summary also read

Video

Comment on this summary