Article

Understanding Non-Prime Borrowers and the Need to Regulate Small Dollar and “Payday” Loans

Brookings Institution,

2016

Read or listen offline

Amazon Kindle

auto-generated audio

1×

Log in to listen to the audio summary.

auto-generated audio

Recommendation

In June 2016, the US Consumer Financial Protection Bureau proposed a rule to govern the financial products that constitute “payday lending.” The rule, which could take effect in 2018, places stricter guidelines on vetting a customer’s ability to repay debt that often carries extortionate interest rates. In this comprehensive analysis, economist Aaron Klein explains in clear, plain language that federal regulation is necessary, given the dangers associated with predatory lending. getAbstract recommends his compelling report to financial professionals and policy makers.

Summary

About the Author

Aaron Klein is a fellow in economic studies at the Brookings Institution.

By the same author

Report

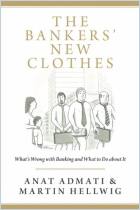

Learners who read this summary also read

Report

Video

Article

Comment on this summary